Benefit Advice Notice

Your pension pay stub

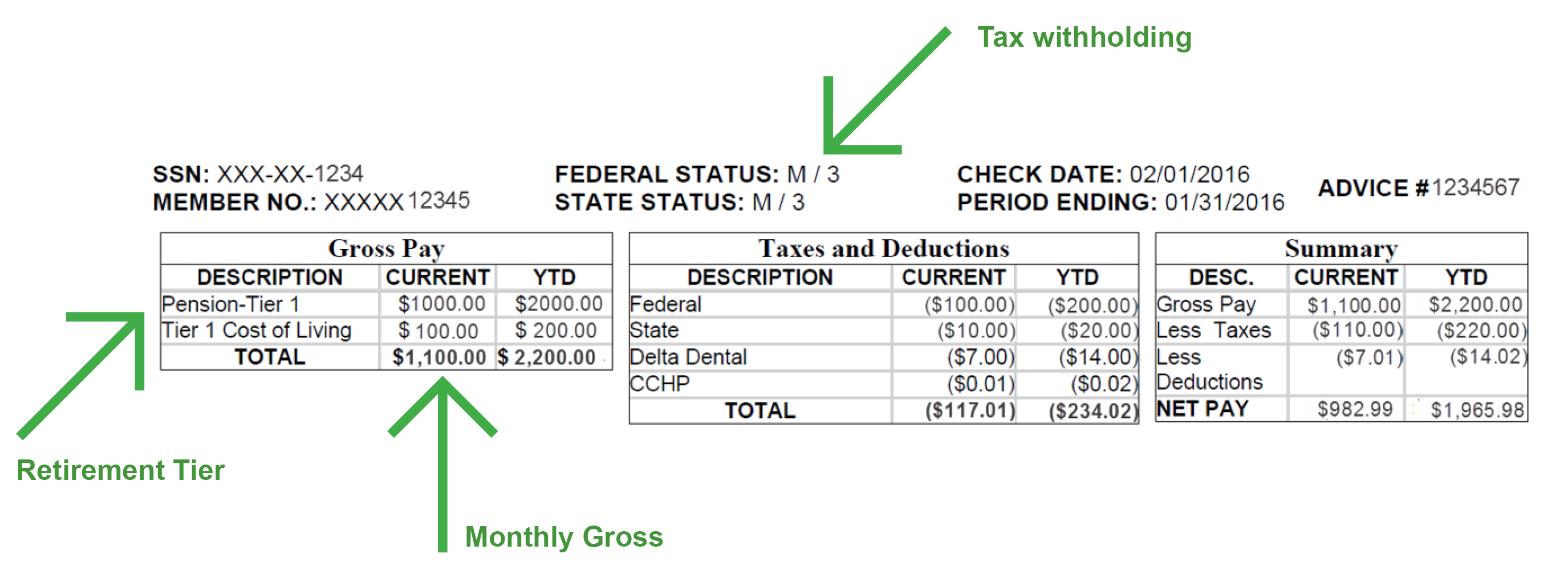

Your benefit advice notice is mailed every month. This document can be helpful to find your retirement tier(s), your current tax withholdings, and to calculate your new retirement benefit including the annual COLA.

Your tax withholding election is listed at the top of your benefit advice. You can change this at any time by filing the IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments, and California State Form DE-4P, Withholding Certificate for Pension or Annuity.

Your retirement tier(s) is listed in the first section of your benefit advice. To find more information about the benefits associated with your tier(s), refer to your specific handbook. Your tier will also be helpful in determining your Cost-of-Living Adjustment (COLA).

Your total monthly gross pay is also listed in the first section of your benefit advice. This number is helpful in determining your COLA. To estimate your COLA, take this number, and multiply it by the decimal form of your COLA percentage.

For example, in 2024, if your current monthly gross pay is $1,100 and you are in Tier 1, then you would multiply $1,100 by 1.03, which results in a monthly retirement benefit of $1,133.

To illustrate:

| 1 | Enter your most current monthly gross pay amount from your latest benefit advice notice. | $1,100 |

| 2 | Enter the decimal form of your COLA percentage for 2024. For example, a 3% COLA is expressed as 1.03 and a 2% COLA is expressed as 1.02. |

1.03 |

| 3 | Multiply line 1 by line 2 and enter the result here. This is your estimated 2024 monthly retirement benefit, beginning May 1, 2024. | $1,133 |