Leaving Before Retirement

Termination of your membership in CCCERA can occur for a variety

of reasons, but usually this means you no longer work for an

employer participating in CCCERA. Membership termination can also

occur if your job status changes to an ineligible position, for

example, to less than half-time, or to a contract position. If

you have changed jobs to an ineligible position such as a

contract position or less than 20 hours per week employment, but

are still working for a CCCERA employer, you may not withdraw

your contributions. If you formally terminate you can either take

a refund or defer your membership.

If you are rehired by a participating employer after you terminated employment, you will rejoin CCCERA unless you are rehired in an ineligible position. Service credit starts accruing just as it did during your previous membership on the first day of the month following your rehire date.

CCCERA will receive notification of your termination from your

employer’s human resources department and will send you a packet

explaining the options concerning your retirement account and

possible tax liability. A Distribution Election Form (Form

207) and instructions for filling out the form are included.

Return the completed form to CCCERA.

Taking a refund means you close your retirement account by

withdrawing or rolling over all of the contributions and interest

you made while a member of CCCERA. You will no longer be entitled

to a benefit from CCCERA, even if you are disabled in the future.

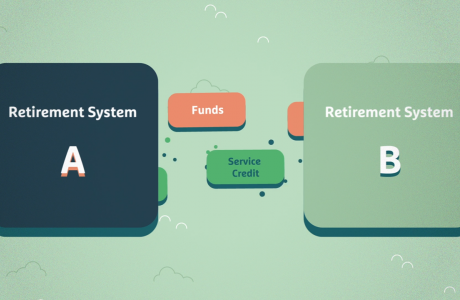

Deferring your retirement membership means you leave your funds

in your account at CCCERA earning interest. This means:

Members of CCCERA who have at least five years of retirement

service credit are vested in the system. Non-vested means a

member has terminated employment before achieving five years of

service credit.

Disclaimer

CCCERA makes no representations or warranties, expressed or implied, with respect to the materials found at this site. It is intended for general information purposes only. In addition, CCCERA cannot and does not represent that the information on this website is current. While CCCERA has made every reasonable effort to offer the most current information possible, inadvertent errors can occur.

CCCERA is governed by California law as well as the Internal Revenue Code and various rules and regulations, all of which are complex and subject to change. In the event of any conflict between these governing authorities and the information on this website, the governing authorities have precedence. Site users are strongly encouraged to consult with a CCCERA representative about specific issues and not rely on the general information contained in this website.

The information provided is not intended to serve as legal advice or as legal opinion. By using this site, the site user agrees to release and hold CCCERA, and its agents and representatives, harmless from any and all claims, demands, and causes of action of any kind or nature whatsoever now and in the future arising out of or in connection with the use of this site or the information provided herein.