As a member of CCCERA, you may be eligible for the benefits of

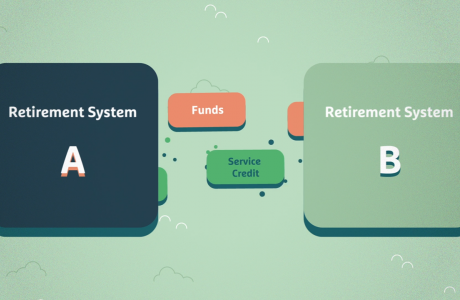

reciprocity. Reciprocity is an agreement among public defined

benefit retirement systems to allow members to move from one

public employer to another public employer within a specific time

limit without losing some valuable privileges related to your

retirement benefits. There is no transfer of funds or

service credit between retirement systems when you establish

reciprocity. You become a member of both systems and are subject

to the membership obligations and rights of each system (for

example, minimum retirement age may vary between systems), except

as modified by the reciprocity agreement. You must apply to

retire from each system separately, and you will receive separate

retirement allowances from each system. You must retire on the

same date from each public retirement system participating in a

reciprocal agreement for all benefits of reciprocity to apply.

Reciprocity Benefits

The following benefits and requirements apply to CCCERA members

who make a qualified move between reciprocal retirement

systems.

-

Legacy Benefit Tier: The California Public

Employees’ Pension Reform Act of 2013 (PEPRA) requires new

benefit tiers for new members on or after January 1, 2013.

Reciprocal members who were in a legacy (pre-PEPRA) tier with a

prior reciprocal employer will be eligible for a legacy tier

with CCCERA.

-

Member Contribution Rate Based on Age at Entry (Legacy

Tiers Only): Retirement formulas for CCCERA legacy

tier members are based on age at entry; with a lower age at

entry generally meaning a lower contribution rate. CCCERA uses

the age at entry of the first reciprocal system to determine

the contribution rate.

-

Highest Final Compensation: CCCERA will

compute your final average compensation based on the

highest rate of pay under any system, as long as you retire on

the same date from all systems. Systems will use either a 12-

or 36-month consecutive highest final compensation depending on

benefit tier.

-

Qualification for Benefits: Service earned

under all reciprocal systems may be used to meet each system’s

vesting and retirement eligibility requirements.

Reciprocity Requirements

When changing retirement systems, you must satisfy several

statutory conditions, as follows, in order to receive the full

benefits of reciprocity:

-

Maintain Membership: You must continue

membership in the first retirement system by leaving your

service credit and contributions (if any) on deposit.

-

Movement to a New Reciprocal System: You must

have a date of membership in the new system within six months

of leaving the old system. The six months is extended to one

year if termination was due to lay off because of a lack of

work, a lack of funds, or a reduction in workforce.

-

No Overlapping Service: You must discontinue

your employment relationship from the first system before

entering employment with the subsequent system.

-

Concurrent Retirement between Reciprocal

Systems: In order to receive full reciprocal benefits,

you must retire on the same date from both or all systems by

submitting a retirement application in accordance to the rules

and regulations applicable to each system.

-

Exceptions and Restrictions: Certain

exceptions and restrictions may apply. Eligibility for

reciprocity is determined by the retirement laws in effect at

the time of movement between retirement systems

Important Restrictions

-

Concurrent Employment: Reciprocity does not

apply when your employment under the first retirement system

overlaps your employment under the new system. For the benefits

of reciprocity to apply, you must terminate employment under

the first system prior to entering employment with the

subsequent system. Reciprocity may not be established even if

the overlapping time is due only to using vacation or leave

time with the first employer while becoming member of the new

system.

-

Refund Restriction: Some retirement systems

may not allow you to withdraw your member contributions while

you are employed in a position covered by a reciprocal

retirement system.

Reinstatement From Retirement

If in the future you reinstate to active employment in a

CCCERA-covered position and have retired under reciprocity, there

is no provision in the law to allow you to apply reciprocal

rights to your subsequent retirement since you will no longer be

retired from both systems on the same date. If you have any

questions regarding reciprocity, including the requirements,

restrictions or benefits of reciprocity, contact our office.